Operator Challenges #1: Declining Revenue and the Telecom Squeeze

Estimated reading time: 4 minutes

Technetix Business Development Director, Amelia Streeter Smith, examines the biggest operator challenges in today’s telecoms industry. Our first instalment in this eight-part series looks at the impacts of drops in Average Revenue Per User (ARPU). Should operators consider solutions like Technetix’ Virtual Segmentation to stay ahead during ‘the telecom squeeze’?

Declining ARPU is reshaping the telecom landscape and intensifying competition across every segment. As connectivity becomes more commoditized, pressures mount on providers to offer more services for minimal price increases.

The likes of WhatsApp, Zoom, and Netflix employ existing telco infrastructure to capture market share. As a result, revenue streams generated by SMS and voice are under attack from Over-The-Top (OTT) platforms. Meanwhile, high CapEx for 5G networks, fiber rollouts, and other digital upgrades places even more pressure on operators.

Compounding factors

Financial and reputational hurdles associated with physical network expansion compound the issue. Constructing new fiber routes or extending network nodes is expensive, time-consuming and often disruptive to consumers and communities. Despite obvious long-term benefits, investing in infrastructure is unappealing for many operators.

So, what now?

The need for solutions that extract more value from existing networks. In parallel accelerating deployments of new services is clearly needed, urgently.

Increasing focus is on strategies that optimize existing infrastructure, enable rapid service rollout, but don’t balloon CapEx or OpEx. For operators, the goal is delivering digital-first experiences to end users. To do this, networks need robust upstream and downstream capacities. This is to handle higher throughput, deliver faster broadband speeds, and maintain performance during peak usage hours.

Achieving these objectives isn’t just about improving service quality. It’s a key factor in reducing customer churn and driving accelerated time-to-revenue for new products and services.

A solution: Virtual Segmentation

Traditional approaches to network upgrades often tie service capacity directly to physical node splits. This can force operators into costly infrastructure projects when incremental upgrades might suffice.

This is where innovative solutions like Virtual Segmentation (VS) come into play.

VS decouples service group size from physical node splits, allowing operators to scale network capacity more efficiently. Resources are intelligently partitioned and traffic management is optimized to defer significant CapEx while measurable performance gains are delivered.

Operators who’ve leveraged Virtual Segmentation have reported upstream and downstream capacity increases exceeding 30%. This has been without the need for disruptive, high-cost construction projects.

By enabling better accommodations for bandwidth-intensive applications and OTT services, it improves network performance without excessive investment. But crucially, it reinforces service reliability for better end-user experiences. VS also supports new digital service rollout for enhanced customer engagement. This mitigates pressures from customer expectations and competitive market forces.

What is Virtual Segmentation?

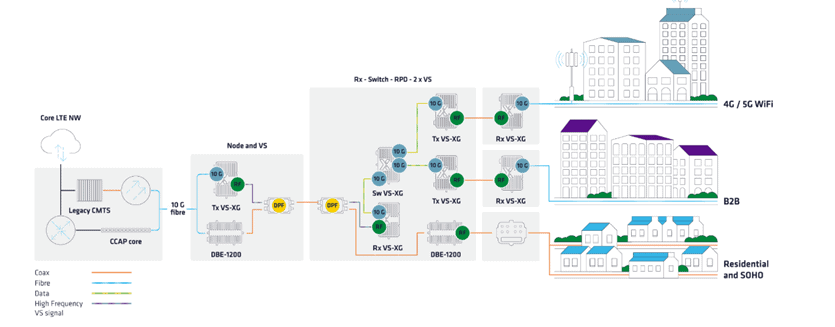

VS is an RF overlay that is deployable in any broadband cable network. Often, coax cables are capable of supporting capacities up to 4,000 MHz; yet bandwidths infrequently exceed frequencies of 1,218 MHz. This leaves around 2,800 MHz of available, unused frequency potential. VS uses this ‘spare’ frequency over 1,218 MHz to simulate fiber-like connections.

Delivering high-quality digital services quickly invigorates revenue growth. It also strengthens a key metric in a market where ARPU is under constant downward pressure: customer loyalty.

The outlook, but make it virtual segmentation

The telecom landscape is undeniably challenging. But operators don’t need to tackle these pressures through costly, slow, and risky infrastructure expansion alone. Intelligent network optimization tools like VS help operators enhance capacities, accelerate service delivery, and control operational and capital costs simultaneously. OTT platforms continue to disrupt traditional revenue streams and customer expectations are higher than ever. Maximizing existing assets isn’t just advantageous: it’s essential for growth.

With solutions that optimize existing infrastructure, increase efficiency, and support rapid service rollout, today’s challenges turn into tomorrow’s opportunities. Declining ARPU and intensifying competition may be the realities of the market. But with the right strategies, telcos can thrive, not just survive.

If VS sounds like a solution for your network, get in touch for more info about our network consultancy services.

Author: Amelia Streeter Smith

Amelia’s 25-year career spans telecoms, utilities, and transports sectors. Amelia has secured major contracts within the fiber telecommunications industries along the way, and joined Technetix in 2025 to help strengthen our European footprint. Off the clock, she enjoys watersports, competitive clay shooting, and cooking.